Good question! Ain’t it? As we all know, Today, more firms are starting to seek accounts payable solutions that automate invoicing and payments processes, as they look to cut costs, decrease fraud, improve efficiency, and gain more visibility into payment data. These changes are bringing a deluge of providers — including software companies, card networks and providers, banks, and payment networks — into the ecosystem. And this means that, there’s a tremendous necessity of Accounts Payable Automation.

What market says?

Now, let’s have a look at the terms of sheer market size, this segment is Huge and growing at an exponential rate. MarketsandMarkets report says that The global AP automation market size is expected to grow from $1.9 billion in 2019 to $ 3.2 billion by 2024. This attributes to an 11% CAGR growth rate owning a huge chunk to IT spending on the automation of the payable processes to enhance business growth and reduce losses.We all are evolving and moving towards globalization. Psst! And, that leads to a disgusting and time-consuming process.

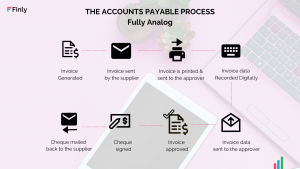

Let me walk you through the problems in this process that industry has lived with for quite some time now.

What are day to day issues, faced by the industry?

1. High cost:

Just Imagine, you are a part of the Finance team of a relatively huge company. You have one day to sort 50 invoices coming to you in different formats like pdf, png or anything. Boring? isn’t it? Yes, indeed!. And, eventually, you start thinking that you are not adding any value to the company because you’re doing this every time, manually. There’s no system that could help you in managing invoices.

The process of receiving invoices from suppliers can be very complex. Suppliers usually send invoices in different formats and through different mediums like email and fax. Invoices can arrive in different formats like PDF, DOCX, XML, PNG, JPG, TIFF, fax files, and even conventional paper. This can be complex for most organizations. The problem is compounded when these invoices are to be sorted, classified into different categories and further managing the physical copies becomes more ambiguous. Any company that values its employees’ time shouldn’t do this manually.

2. No Transparency:

Once invoice sorting is done, you have to check and match the invoice and that too manually, Oh Gosh! Before paying an invoice for goods acquired through a purchase order (PO), the invoice must be matched against other relevant documents, including receiving reports, to ensure that only the correct invoices are processed and paid. It causes a lack of understanding, what all payables are upcoming.

3. Large turnaround times:

You spend your weekdays and weekends doing this. No weekends :(! That’s too bad.

Manual data entry is one of the most tedious accounts payable processes. It’s time-consuming, costly, error-prone, and downright boring. And after all, who likes delayed audit closures?

4. Manual Checks:

Even if you’re done with matching and data entry, still you can’t shout Yay, because there’s a lot to do yet. Before an invoice is processed, it must go through a series of approval for authorization. You also need to ascertain the invoice’s validity and accuracy. Without such assurances, it cannot be paid. These approval often occur at different stages handled by different people.

5. Late Payments:

Wait and Watch! That’s what you can do right now.The purchasing department might have to approve the invoice to confirm the suppliers’ billing is accurate. And just before payment is disbursed, someone in management, (say, the CFO) might have to give it a final approval to ensure that the correct amount is paid into the right account. For an invoice to be approved, it must go from approval to approval. If a company processes invoices manually, it means that a paper invoice would have to go from desk to desk for the series of approval. This is the major reason for the delay in payment processing in organizations.

6. Lack of Governance and Policy Controls:

It becomes difficult to control norms and check manual errors. Ensuring everyone is sticking to right and standard operating procedures, it is necessary to keep track of vendor terms, clauses and agreements. It is indeed important to adopt robust governance practices.

What is the process of Accounts Payable Automation (APA)?

After all these processes are done, you finally sit on your couch, passing your time on social media and Alas! You came across this blog, which is the story of yours and at the point, after doing all these processes, you come to know that there’s an automatic process to do this task. Now, these problems need to be solved and that can only be done by the boom of Accounts Payable Automation Industry. I know you must be thinking how does the rise of APA help in the resolution of these issues? Simple! Remove the redundant work in the system, standardize the process, fix the algorithms according to one’s requirement and you are there. You have figured out a crack to $ 3.2 Billion Industry.

Automation of the processes not only helps in reducing cost but increases efficiency, reduces the risk of fraud, gives more visibility and data insights into payments and helps in maintaining good vendor relations. (who doesn’t like money on time?)

But, What is Account Payable Automation aka APA? Who will explain it to you? How would you inculcate it? Why use it? Huh? Don’t worry, here’s the answer.

According to SAP Ariba, Accounts payable process automation is a method of minimizing human intervention and eliminating error-prone tasks from the accounts payable process. AP automation delivers greater efficiency and effectiveness. AP Automation enables companies to toothless process supplier invoices without any human intervention by providing a digital workflow to manage steps previously handled by staff members. Automated accounts payable systems can create a process that’s simpler, more accurate and highly efficient. It helps in reducing the business payment cycle, governs the financial policies, automates the approval mechanisms and stores the record in a digital archive — making the entire process paperless.

Yes, now you can sit and do this in minutes because disruptive technology has enabled accounting teams to eliminate a lot of unnecessary manual intervention that was dragging down operational efficiency. Accounts payable plays a crucial role in business operations in ways many companies are only just starting to realize. We all know that this job function is what keeps the lights on in your office, but it also has a direct impact on cash flow management. The APA industry is a great product-market fit, as it will play a very crucial role in making eternally successful fully automated organizations.

This certainly has the sound of ruling the corporate world which will definitely take your financial aspects to the next level.

Also, Could you think of the detailed steps and challenges involved in Accounts Payable ? Give it a thought until we meet next time. Get Going!